Senior (65 years old or older) Discounts and Benefits

Southwest Regional Senior Center is a place for older adults 60+ to belong. We offer activities and programming to keep our older adults healthy, active, and socially engaged. We also provide daily meals through our Congregate Dining Program (2.00 suggested contribution), Illinois Benefit Access assistance, and daily RTA services. Below are flyers highlighting upcoming events.

CITY OF CHICAGO

Senior Services

A variety of support services are available citywide to address the diverse needs and interests of older adults, from those who are active and healthy to those residing in long-term care facilities and seniors who are fragile and may be confined at home.

Chicagoans 60 and Over: Need Help at Home?

Chicago Seniors Connected Brochure

The Department of Family and Support Services’ Senior Services Division has released the updated spring edition of the “Chicago Seniors Connected” program brochure, which lists both virtual and in-person programmatic opportunities along with upcoming events and special meals!

Some of the Key events featured in the brochure include:

- New Feature – DFSS Senior Center Special Events & Programs Section (pg. 33-50) This newly added section highlights event programming across our 21 senior centers. Please reach out directly to your local area senior center for the full daily calendar of programming opportunities and events.

- Returning & Expanding Programming:

- DFSS Senior Services & CDPH sponsor a returning event “Let’s Talk about Grown Folks Business” (pgs. 52-53). A Senior Health Fair providing vaccination opportunities and presentations specifically tailored for older adults including substance abuse, vaccination hesitancy and sexual health information.

- Meals on Wheels Chicago and DFSS Senior Services expand the dynamic Nourish Chicago Meals on Wheels Pop up pantry to the Southeast and Southwest Regional Senior Centers (pg. 30). Cooking demonstrations are also incorporated as part of nutritional programming.

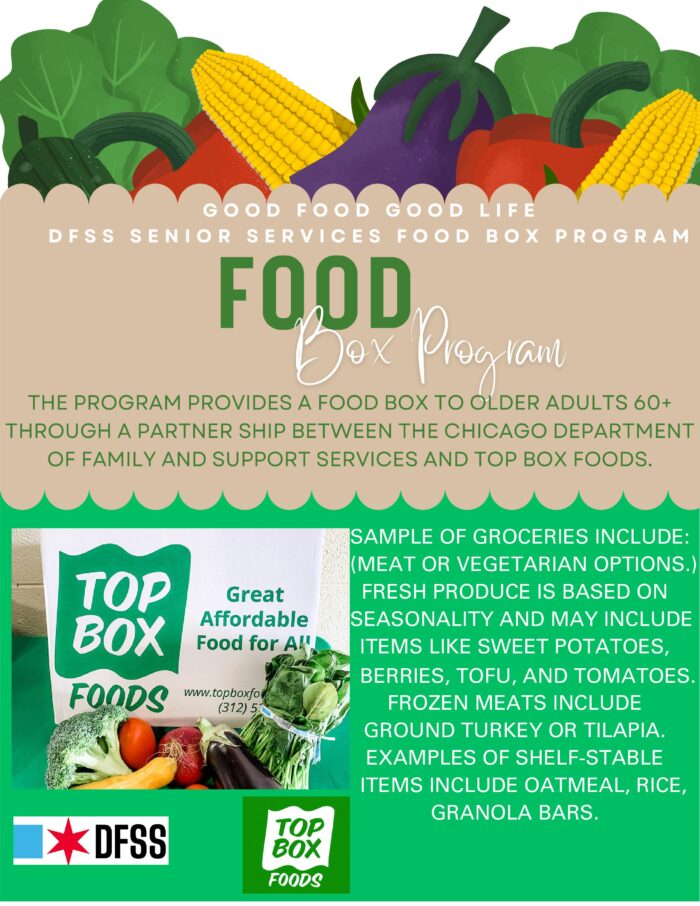

- Good Food Good Life DFSS Senior Services Food Box distribution returns to our six Regional Senior Centers (pgs. 28-29). Food boxes containing pounds of fresh fruit, vegetables and protein. Available while they last.

- DFSS Senior Services & CDPH launch a pilot program focused on mental health, behavioral health and trauma informed care (pg.64) at our Northwest and Northeast Regional Senior Centers. Envision Unlimited will provide “Lunch and Learns” on aging and mental health as well as provide individual and in-home counseling to seniors in need.

Senior Citizen Sewer Service Charge Exemption & Rebate

The Senior Citizen Sewer Exemption entitles seniors aged 65 or over, residing in their own residence with separate metered water service or a separate city water assessment for that residential unit, to an exemption from payment of the sewer service charge for their residence. This exemption provides substantial savings to seniors.

Senior Citizens, who own and occupy their own residence, but who are not eligible for the Senior Citizen Sewer Charge Exemption due to property type, can apply for the Senior Citizen Sewer Rebate. This provides an annual $50 rebate in lieu of the exemption.

For eligibility and to apply, visit https://www.chicago.gov/city/en/depts/fin/provdrs/utility_billing/svcs/apply-for-utility-charge-exemptions.html.

Shared Cost Sidewalk Program

The Shared Cost Sidewalk Program is an extremely popular voluntary program in which property owners share the cost of sidewalk repair with the City. This popular program consists of low cost, exceptional value, and ease of participation. The program’s cost per square foot charged to property owners is well below what a private contractor would charge. Senior citizens and persons with disabilities may qualify for a further discounted rate.

Applications are taken in early January on a first-come, first-served basis and only accepted through the City’s 311 system by calling 311 or through the City’s service request website 311.chicago.gov. The property owner’s contact information and the property address are required at the time of the request. Please call the office in December with an update as to when the program will open in January.

For more information, visit www.chicago.gov.

CITY CLERK

Senior Discount City Sticker (2025)

Per City Ordinance, residents that meet the requirements below are eligible to purchase one discounted City Sticker at $36 per year for a Passenger (P), Large Passenger (LP) or Motorbike (MB) and one discounted City Sticker at $148.83 per year for a Small Truck (ST).

2025 Updates from the Office of the City Clerk

For senior license types, the costs below will be frozen.

- The City Sticker Annual Zone Fee will remain at $25.

- The Transfer and Reissue Fee will stay at $5.

For requirements and restrictions, visit https://www.chicityclerk.com/stickers/chicago-city-vehicle-sticker-faq.

City Clerk Chicago Senior Guide

COOK COUNTY ASSESSOR’S OFFICE

Senior Exemption

Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as their principal place of residence. Once this exemption is applied, the Assessor’s Office automatically renews it for you each year. A Senior Exemption provides property tax savings by reducing the equalized assessed value of an eligible property.

Low-Income Senior Citizens Assessment Freeze Exemption

Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2022 calendar year. A “Senior Freeze” Exemption provides property tax savings by freezing the equalized assessed value (EAV) of an eligible property. This does not automatically freeze the amount of their tax bill, only the EAV remains at the fixed amount. Tax rates may change and thus alter a tax bill. The automatic renewal of this exemption due to COVID-19 has ended. Applicants must apply annually.

For eligibility requirements regarding the Senior Exemption and Low-Income Senior Citizens Assessment Freeze Exemption, visit www.cookcountyassessor.com.

COOK COUNTY TREASURER’S OFFICE

Senior Citizen Garbage Fee Discount

No application is required. If a customer is currently receiving the Cook County Low-Income Senior Citizens Assessment Freeze, the Senior Garbage Fee Discount will be automatically applied to their utility bill.

For more information, visit www.chicago.gov.

Senior Citizen Tax Deferral

The Senior Citizen Real Estate Tax Deferral program is a tax-relief program that works like a loan. It allows qualified seniors to defer a maximum of $7,500 per tax year (this includes 1st and 2nd installments) on their primary home. The loan from the State of Illinois is paid when the property is sold, or upon the death of the participant. The household income limit to participate in this program has increased to $65,000 or less.

To apply, contact the Cook County Treasurer’s Office at 312.443.5100 or visit www.cookcountytreasurer.com.

SECRETARY OF STATE

Super Seniors

Super Seniors is a convenient and voluntary program for driver’s license renewal, which includes Rules of the Road classroom instruction, and a vision-screening exam. The Rules of the Road Review Course also includes a review of safe driving techniques and Illinois driving laws.

For more information, visit www.ilsos.gov.

Reduced Fee License Plate

The Department on Aging’s Benefit Access Program, formerly the Circuit Breaker Program, allows the Secretary of State’s office to provide a reduced-fee license plate for senior citizens and persons with disabilities with specific qualifications such as age, residency and income.

ILLINOIS DEPARTMENT OF AGING

Benefits Access Program Benefits

- Seniors Ride Free Transit Benefit

- Persons with Disabilities Free Transit Ride

- Secretary of State License Plate Discount

To be determined eligible for these benefits, you must submit a Benefit Access Application on the Internet. Paper applications are not available. Please note that the current processing time to determine the eligibility of your Benefits Access Application is approximately 12 weeks.

For more information and the online application, visit www2.illinois.gov.

Senior Health Insurance Program

The Senior Health Insurance Program (SHIP), which is a free statewide health insurance counseling service for Medicare beneficiaries and their caregivers. Visitors will find information and resources about applying for Medicare, sites in their area that they can get assistance applying for Medicare and tools for SHIP sites around the State to utilize in serving Medicare beneficiaries.

For more information, visit www2.illinois.gov.